April 2024 Print Edition

Conference General Session: Submit your questions for SSA NOW!

In exactly two weeks, NOSSCR will welcome high-level SSA staff, including the Commissioner, to our General Session. We are excited for you to hear directly from those in charge of the various components that our members interact with daily.

Advocacy before the agency is a key mission of NOSSCR, and NOSSCR is its members. We invite you to submit a question here that you’d like SSA to address during the General Session.

In the coming days, be on the lookout for a “know before you go” guide via email for the important details on checking in, continuing education credits, conference networking events, and more.

President’s Corner

Rick Fleming, NOSSCR President

I look forward to seeing you in Nashville for the 2024 NOSSCR annual conference. We have top-notch sessions plus a lot of events planned that you will not want to miss. We’ve incorporated live music, meals, and lots of opportunities to network and enjoy time with new and old friends. I want to highlight one event—the President’s reception. We’re excited to announce that we’ve made this event FREE and open to all attendees. It will be held on Friday, May 10, from 6:00 to 7:30 pm in Legends Ballroom. Please plan to come by and say hello.

Reminder: There’s an extra step to sign up for events like the Scully Networking & Awards Dinner and the morning yoga. Add them to your registration in one of two ways:

- Click on the “My Participation” tab of your NOSSCR profile and scroll to the bottom of the page to add program items.

- Click “Register” from the conference page and scroll down to “Upcoming events” to find your registration. Click “2024 NOSSCR Annual Conference” and scroll to the bottom of the page to add program items.

Our general session will include Commissioner Martin O’Malley, who, as I believe you will agree, has had the most productive first 100 days many of us have ever seen. From the multiple Federal Register publications, the fee cap adjustment, the work on overpayments, and his site visits to SSA Field Offices, Commissioner O’Malley hit the ground running. NOSSCR has actively partnered with the Commissioner since day one to tackle issues and improve the lives of claimants, their families, and those who advocate on their behalf.

I would also like to encourage those who can donate to give to the Rudolph Patterson Scholarship Fund. Your gift helps other members attend events they may not otherwise be able to afford. Thank you in advance for your generosity. Follow this link to give: http://portal.nosscr.org/foundation

Let’s talk about fee agreements

Jennifer Cronenberg, Senior Counsel, Director of Legal Information

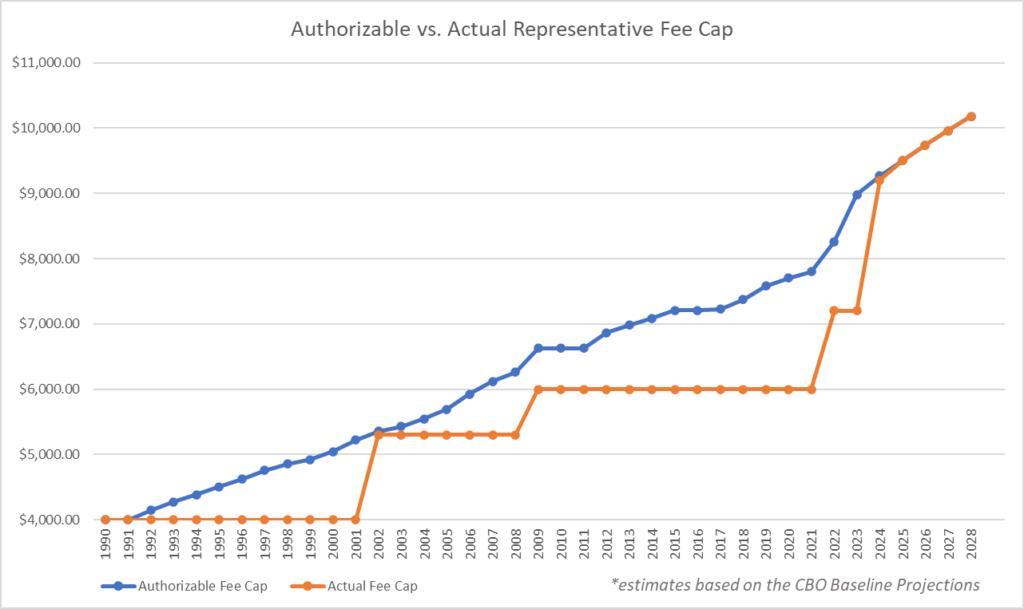

In light of the recent good news regarding the representative fee cap increase, I wanted to take a moment to discuss fee agreements.

First, as a reminder, the fee cap increase is not yet in place. We expect an announcement in the Federal Registrar soon, with an effective date beginning in the fall. However, even though the increase is not yet effective, it is good practice to review your fee agreements and ensure that they are using the proper escalator language so that you can benefit from the increase as soon as it becomes effective.

Social Security does not require that representatives use a specific fee agreement or specific fee agreement language. They do provide their own fee agreement that representatives can choose to use, but use of this form is not required. They also provide some general guidance regarding the required and prohibited elements for fee agreements on their website. Importantly, there is no one way to structure a fee agreement as long as it meets the statutory conditions of the Act and is not otherwise excepted.

Generally, there are two types of fee agreements: standard and two-tiered. For the standard fee agreement, the representative and client are agreeing to representation for the client’s claim without limitation. The language on that agreement might look something like this:

The client, CLIENT NAME, retains REPRESENTATIVE NAME of ADDRESS to perform the services listed below. REPRESENTATIVE NAME agrees to perform them faithfully and with due diligence.

The services to be performed are to provide representation for CLIENT NAME in HIS/HER claim for Social Security disability benefits (SSDI), Supplemental Security Income benefits (SSI), or both.

REPRESENTATIVE NAME and CLIENT NAME understand that the Social Security Administration (SSA) must approve any fee REPRESENTATIVE NAME charges or collects for services provided in proceedings before the SSA.

CLIENT NAME and REPRESENTATIVE NAME agree that if SSA favorably decides the claim(s), the client will pay REPRESENTATIVE NAME a fee that does not exceed the lesser of 25 percent of any past-due benefits or the maximum dollar amount allowed under the Social Security Act Section 206(a)(2), or such higher amount set by the Commissioner of Social Security based on the date SSA authorizes the representative’s fee. This fee is based on the total of the primary and dependent retroactive awards.

In the event that the client does not become entitled to benefits, there will be no fee payable to the representative.

Here, there is no limit placed on the duration of the relationship as long as the claim is before the Social Security Administration, and the client has agreed to pay the standard 25% of past-due benefits or the statutory cap, whichever is less. If you do not intend to practice beyond the administrative levels, this is a perfectly acceptable fee agreement.

However, some firms know that they might take a claim all the way to federal court, in which case, they may seek allowable additional fees via fee petition. In that case, a two-tiered fee agreement can be utilized—an example looks like this:

I hereby employ REPRESENTATIVE NAME to represent me before the Social Security Administration in my Social Security Disability case, Supplemental Security Income (SSI) case, or both.

My representative and I understand that for a fee to be payable, the Social Security Administration (SSA) must approve any fee my representative charges or collects from me for services my representative provides in proceedings before SSA in connection with my claim(s) for benefits.

I agree that if SSA favorably decides my claim(s) at any stage through the first hearing before an Administrative Law Judge (ALJ), I will pay my representative a fee equal to the lesser of 25% of the past-due benefits resulting from my claim(s), or the dollar limit imposed under 42 U.S.C. § 406(a)(2)(A) at the time of the decision. If I receive both Social Security disability and SSI benefits, I understand that my total fee will not be more than 25% of all past-due benefits, or no more than the limit set by 42 U.S.C. § 406(a)(2)(A), if the limit applies.

If the first ALJ decision after the date of this agreement is a denial and my representative agrees to appeal and I win my case later, my representative will ask SSA to approve a fee no greater than 25% of all back benefits awarded in my case. If the Social Security Administration or Federal law raises or lowers the maximum amount to be charged by a representative, that amount will apply, including amounts which may be approved by an Administrative Law Judge. If this case goes to Federal District Court, the fee maximum does not apply. I understand that the Social Security Administration will hold out 25% of past-due Social Security Disability and/or SSI benefits and pay my attorneys for this work. No attorney/representative fee will be charged if we do not win.

You certainly also have the option of utilizing a standard fee agreement as a starting point, and then supplementing that agreement with a secondary agreement should you choose to take the case beyond the administrative levels. You might want to include a sentence in a standard agreement that indicates this will be your process—something like this would suffice:

I am hiring REPRESENTATIVE NAME to represent me on my Social Security case.

If I do NOT get money from Social Security, there will be NO fee.

If I DO get money from Social Security, the fee will be the lesser of ONE-QUARTER (25%) of the “back money” that I get, or the maximum dollar amount set as the cap by the Commissioner of the Social Security Administration. If the cap is increased by the Commissioner, as allowed by statute, the limit on the fee will be the new cap set by the Commissioner at the time of claim approval. “Back money” includes all money going to me and my family under regular Social Security and Supplemental Security Income.

In addition, if I win, I will pay my representatives back for the costs of getting medical records and copying my file.

As soon as I get any money from Social Security, I will let my representatives know and I will pay them their fee.

This contract covers only representation before the Social Security Administration. If I want to appeal my case to Federal Court, my lawyers and I will have to make a further contract concerning representative fees.

Your fee agreement can also include provisions on whether or not you will charge for administrative costs, how long you will retain the client’s file, and expectations for two-way communication. As the first example above does, you may also want to make clear that auxiliary benefits may also comprise a portion of your fee within the statutorily allowed limit.

Perhaps most importantly, your fee agreement’s escalator language needs to be clear. As we previously announced, the Commissioner has agreed to continue to raise the fee cap along with the annual COLA increases. This means that the fee cap amount is likely to change annually, and SSA will be closely checking fee agreements to make certain that the proper escalator language exists before they apply the current cap. Although there is no requirement to do so, we recommend removing the number figure from the fee agreement altogether, leaving in place only the escalator language indicating that you can charge up to the statutorily allowed limit. All three examples above include acceptable escalator clauses without listing a particular dollar amount.

Finally, if you work at a firm or organization where multiple representatives may represent the claimant at various stages of the claim’s life, in order to avoid a fee petition, all representatives must sign a “single fee agreement.” SSA defines this as “one agreement signed by all parties to the agreement. Therefore, if the claimant appoints a representative after submitting a fee agreement, the representative must sign onto the first agreement or the claimant and representative must submit an amended agreement signed by all.” Different firms have different practices for accomplishing this goal—some have all employed representatives sign the same fee agreement from the beginning, others simply take the original fee agreement that was signed with one representative and have any subsequent representative sign and date the same piece of paper (with the claimant re-signing and re-dating the same form each time a new representative signs on). While neither method is perfect, both have proven effective in getting fees properly paid to a firm without the need for a fee petition.

As discussed in the September issue of The Forum, we continue to await a final rule in SSA’s proposed “changes to the administrative rules for claimant representation and provisions for direct payment to entities” which we hope, once finalized, will provide clarity in how SSA can pay entities like law firms when more than one salaried employee works on a case. But, until then, please continue to utilize the everyone-signs-a-single-fee-agreement approach as detailed above.

We will continue to monitor all progress on the fee cap, signature requirements, and payments to entities and will immediately update you with any important changes. In the meantime, please enjoy the projected future fee cap increases below.

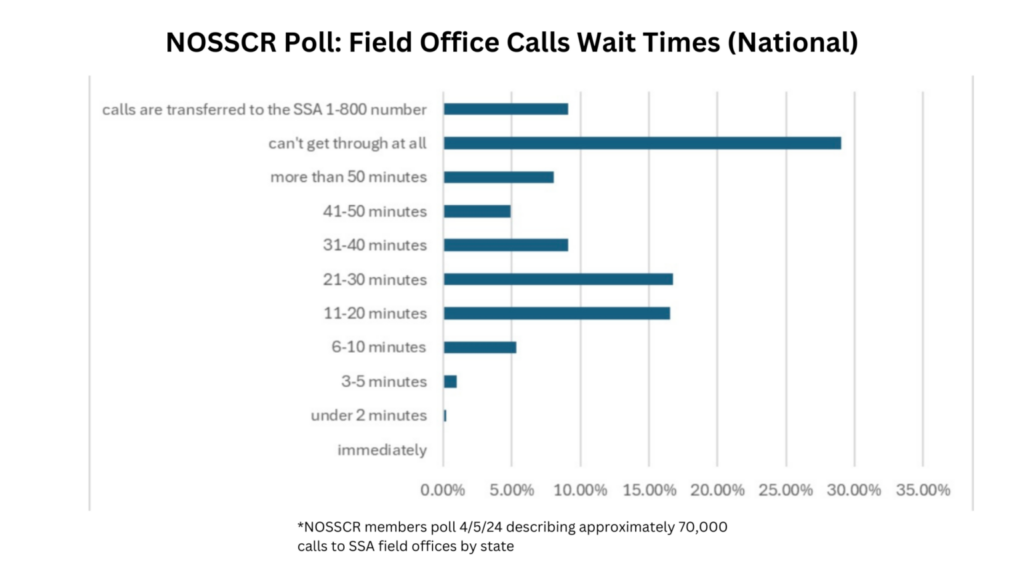

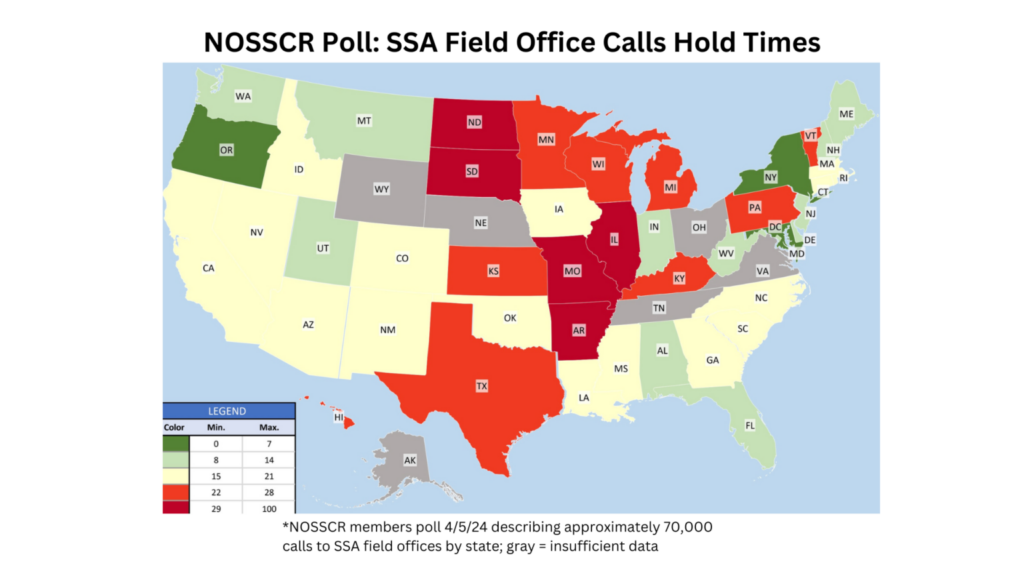

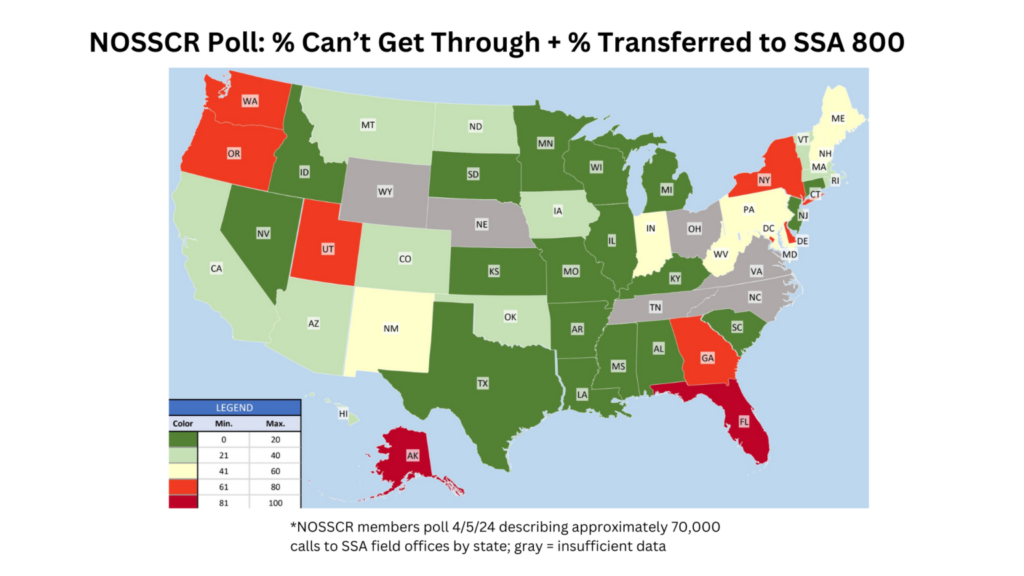

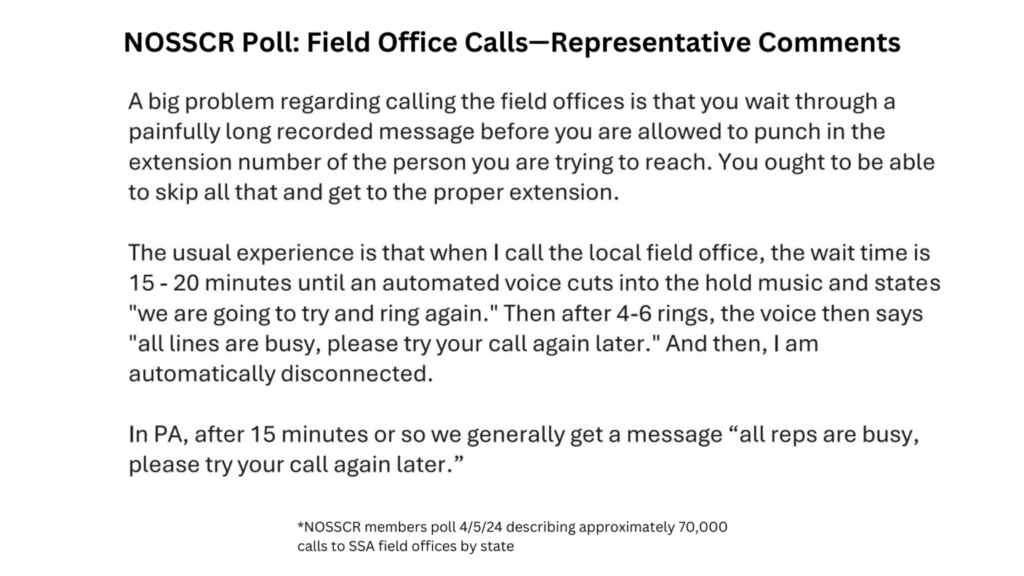

Results of NOSSCR survey on FO wait times

NOSSCR is only as strong its members, and we are grateful for your collective responsiveness. Recently we asked for your SSA call wait time experiences. The results of that survey were immediately and directly shared with Commissioner O’Malley and his SecurityStat team and are included below.

As the Commissioner strives to improve customer service agency-wide, NOSSCR’s capacity to quickly provide valuable representative data like this is crucial.

Piemonte’s Perspective

George Piemonte

Last time, I discussed the six good grids and how you can prove your claimants meet them. But most claimants don’t meet a grid rule, so today, I will discuss how you can win your claimants’ cases that do not meet a grid rule.

First, let’s cover what types of proof you can use to prove your claimant is disabled. In addition to your claimant’s testimony, other types of evidence are:

- Written statements and testimony

- Medical records reporting the client’s statements

- Medical opinions

- Clinical and laboratory findings

- School records

- Photographs

You want to try to prove all limitations in multiple ways. The more ways you prove your claimant’s limitations, the more likely the ALJ will find that they are limitations.

Always emphasize the significance of the claimant’s testimony to prove disability. Your claimant must testify about their limitations and how they impact their daily functioning. By doing so, you’re empowering your claimant to play a pivotal role in their case. If your claimant does not testify to these limitations, there’s a risk that the ALJ may infer that they are not significant. This could potentially weaken your case.

Always make every possible effort to have medical opinions that prove disability. Sometimes, this is easier said than done, but you must always try to get a medical source statement(s) of your claimant’s functional limitations. Be sure to tell your claimants they must tell their doctors and other health care providers everything that is wrong and not to minimize what is happening (but don’t exaggerate). Remember, per SSR 16-3p, the ALJ is supposed to evaluate how consistent the claimant’s testimony is with the medical evidence.

Always get the VE to say that proven limitations eliminate all jobs. If the ALJ does not adequately explain why any proven limitation was not included in the RFC assessment, then you have grounds for appeal, but you must prove that that omission was harmful. If the ALJ does not include proven limitation X in the RFCA, the VE says proven limitation X precludes sustained work; the ALJ did not explain why proven limitation X was not included in the RFCA; therefore, the claimant was harmed, and remand is necessary.

Also, lay evidence supporting disabling limitations should be obtained. Friends and family statements/testimony will show consistency. For example, I once had a claimant’s neighbor, who also happened to be a pastor, come and testify to my claimant’s panic attacks and how he would come to his aide when he was having one. That neighbor’s testimony corroborated my claimant’s testimony about his disabling limitation and won his case.

And do not hide from weaknesses in your case; defeat them. Be sure to address every fact in the record that could be twisted or distorted to be contrary to disability. In other words, search for the dog that didn’t bark in the night. You can’t just close your eyes and hope the ALJ doesn’t find it because, in all likelihood, they will, which could blow up your claimant’s case. Practice paranoid thinking and assume the ALJ will see it, leading to a denial of your claimant’s claim. Meet it head-on to prove it is not contrary to disability, make a record of everything, and trust no one (even your claimant).

When you get past the grids, your job is just starting. Next time, I will focus on what to prove and how to prove it by reviewing some of my favorite limitations.

Remember, you can never provide too much proof of disability or prove too many winning theories.

Updated state medical records payment rates

Many states have laws that waive or limit the amount medical providers can charge for providing copies of medical records when the request is made in connection with a Social Security disability or SSI claim. Some states have limits that apply to all requests, regardless of purpose, while other states have no limits at all. Below is a summary of the relevant state laws. While we strive to keep this list updated, if you notice a discrepancy between this list and your state’s rules, please send us an email at nosscr@nossrc.org.

Many of the state laws that limit costs exist because NOSSCR members contacted their state representatives and pushed for helpful legislation. If you are interested in contacting your state representative to pass a similar statute, please reach out to NOSSCR for assistance.

Alabama: $1 per page for the first 25 pages, 50¢ per page for each additional page, and a search fee of $5. Reasonable costs also include the actual cost of mailing the records. In addition, the provider may also charge the actual cost of reproducing X-rays and other special medical records. Code of Alabama § 12-21-6.1.

A note on the search fee: if the individual requests their own records, per HIPPA, the search fee must be waived; however, this required waiver applies only to an individual’s request for access to their own records and does not apply to an individual’s request to transmit records to a third party.

Alaska: Although Alaska Statutes § 18.23.005 specifies that “a patient is entitled to inspect and copy any records developed or maintained by a health care provider or other person pertaining to the health care rendered to the patient,” no state law limits the costs of providing copies of medical records.

Arizona: One free copy of a patient’s medical records per calendar year if requested by the patient or the patient’s legal representative “for the purpose of appealing a denial of benefits under the social security act.” Before obtaining a patient’s medical records free of charge, “[a] legal representative must provide an Appointment of Representative Form SSA-1696.” Any additional requests for medical records in the same calendar year are subject to “a reasonable fee” for the production of the records. But no fees may be charged if no medical records are found in response to the request. Arizona Revised Statutes § 12-2295.B.5.

Arkansas: For paper records: 50¢ per page for the first 25 pages, 25¢ per page for each additional page, and a $25 labor charge. The actual cost of any required postage can also be charged. However, these per page limits do not apply to photocopies of x-rays.

For electronic records: $75 and the actual cost of postage, if any postage is required. No other fees may be charged for electronic records. Medical records requested that exist in electronic format shall be produced within 30 days after receipt of the request.

Additional “reasonable fees” can be charged for retrieval of records stored offsite and for narrative medical reports. Arkansas Code § 16-46-106(a).

California: One free copy of a patient’s medical records for “a patient, employee of a nonprofit legal services entity representing the patient, or the personal representative of a patient” if the records are needed to support a claim or appeal regarding eligibility for a public benefit program, which includes Social Security Disability Insurance Benefits and Supplemental Security Income benefits. Notably, the provision granting one free copy of the patient’s medical records does not apply if the patient is represented by a “private attorney,” meaning any attorney not employed by a nonprofit legal services entity, who is paying for the costs related to the patient’s appeal, pending the outcome of that appeal. In that case, the medical provider may charge 25¢ per page for paper copies or 50¢ per page for records that are copied from microfilm, plus the costs of labor, supplies, and postage, if applicable. If the records are requested to support a claim or appeal regarding eligibility for a public benefit program, the medical provider must “ensure that the copies are transmitted within 30 days after receiving the written request.” California Health & Safety Code, Division 106, Chapter 1, § 123110.

Colorado: $18.53 for the first 10 pages, 85¢ per page for the next 30 pages, and 57¢ per page for each additional page. These costs do not apply to medical records that are stored on microfilm, which cost $1.50 per page, or radiographic studies, which cost the actual cost of reproduction for each radiograph copy. Additionally, the medical provider may charge the actual postage and electronic media costs, if applicable, and any applicable taxes as well as a $10 fee for certification of the medical records, if requested.

However, a third-party entity that is performing duties under the Laura Hershey Disability Support Act, which funds a program that awards contracts to nonprofit organizations “to aid persons with disabilities in accessing disability benefits…,” is entitled to one free copy of a patient’s medical records “when required by the disability benefit administrator.” Colorado Revised Statutes § 25-1-801.

Connecticut: No charge for medical records requested by a patient, patient’s attorney or authorized representative “for the purpose of supporting a claim or appeal under any provision of the Social Security Act…” The request must be accompanied by documentation of the claim or appeal. The medical provider must furnish the records within 30 days of the request. Connecticut General Statutes § 20-7c(d).

Delaware: $2 per page for the first 10 pages, $1 per page for pages 11-20, 90¢ per page for pages 21-60, and 50¢ per page for pages 61 and above. The actual cost of reproduction may be charged for records unsusceptible to photocopying, such as radiology films, models, photographs or fetal monitoring strips. The medical provider may also charge the actual cost of postage or shipping if the records are mailed. Advance payment for medical records requested to make or complete an application for a disability benefits program is not required. Delaware Administrative Code, Title 24, Division 1700, § 16.0.

District of Columbia: For electronic copies, medical providers may charge an authorized person 68¢ per page, not to exceed $89.66 total, and a $23.70 search and handling fee (even if no personal medical record is located).

For non-electronic copies, medical providers may charge an authorized person 91¢ per page (with no maximum), a $23.70 search and handling fee (even if no personal medical record is located), and the actual cost for postage and handling.

These fees will be adjusted annually for inflation. The 2024 rates are reflected above and located here.

The medical provider must provide copies of the records within 30 days of receipt of the request. Code of the District of Columbia § 3–1210.12. For requests by a patient or a person with a health care power of attorney for the patient, medical providers may charge “a reasonable fee for copying.” Code of the District of Columbia § 3–1210.11.

Florida:

Hospitals: $1 per page, plus sales tax and actual postage. Non-paper records (such as microfiche) are subject to a charge not to exceed $2 per page. A fee of up to $1 may be charged for each year of requested records. However, this does not apply to records maintained at any licensed facility that primarily provides psychiatric care, or to records of treatment for any mental or emotional condition, or records of substance abuse. Florida Statutes, Title XXIX, Chapter 395, § 3025.

Doctors: While “the Board of Medicine urges physicians to provide their patients a copy of their medical records, upon request, without cost, especially when the patient is economically disadvantaged,” the doctor is permitted to charge “patients and governmental entities” $1 per page for the first 25 pages and 25¢ for each additional page. For “other entities,” the reasonable costs of reproducing copies of written or typed documents or reports shall not be more than $1.00 per page. The doctor may charge the actual cost of reproduction for x-rays and other special kinds of records. Florida Administrative Code § 64B8-10.003.

Georgia: Per § 31-33-3(a) of the Official Georgia Code Annotated (O.G.C.A.), which sets forth the costs of copying and mailing patient records, these costs “shall not apply to records requested in order to make or complete an application for a disability benefits program.” Notably, according to O.G.C.A. § 31-33-3(c), this Code section does apply to a patient’s psychiatric, psychological, and other mental health records. Official Georgia Code Annotated § 31-33-3. See also Georgia Department of Community Health, Medical Records Retrieval Rates.

Hawaii: “Reasonable costs incurred by a health care provider in making copies of medical records shall be borne by the requesting person.” Hawaii Revised Statutes § 622-57(g). If the patient’s attorney requests the records and “presents a proper authorization from the patient for the release of the information, complete and accurate copies of the records shall be given to the attorney within a reasonable time not to exceed ten working days.” Hawaii Revised Statutes § 622-57(b).

Idaho: No state law limits the costs of providing copies of medical records.

Illinois: Effective January 1, 2022, no charge for “one complete copy of a patient’s records,” which includes any updated medical records not included in the original record, if “the records are being requested by the patient or a person, entity, attorney, registered representative, or organization presenting a valid authorization for the release of records signed by the patient or the patient’s legally authorized representative who has provided documentation of authority to act for the patient… for the purpose of supporting a claim for… federal Social Security or Supplemental Security Income benefits, or both, under any title of the Social Security Act…” See Illinois Compiled Statutes, Chapter 735, § 5/8-2001(h). See also Public Act 102-0183.

Indiana: The Department of Insurance sets the rules for making and providing copies of medical records. Indiana Code, Title 16, Article 39, Chapter 9, § 2. The maximum copying fees are $1 per page for the first 10 pages, 50¢ per page for pages 11-50, and 25¢ per page for pages 51 and higher. Additionally, the medical provider may charge the actual cost of mailing. A $20 labor fee can also be charged; however, if a labor fee is charged, the first 10 pages are free. An expedited processing fee of $10 may be charged if the records are to be provided within two working days. The medical provider may also charge $20 for certified records. Indiana Administrative Code, Title 760, Article 1, Rule 71, § 3.

Iowa: Medical providers may charge “the actual cost of production” for producing patient records or images. If the properly submitted request is for “all of the patient’s records for the requested time period, including records relating to the patient’s mental health, substance use disorder, and acquired immune deficiency syndrome-related conditions, the amount charged shall not exceed the rates established by the workers’ compensation commissioner for copies of records in workers’ compensation cases.” The workers’ compensation rates are $20 for pages 1-20, $1 per page for pages 21-30, 50¢ per page for pages 31 to 100, 25¢ per page for pages 101-200, 10¢ per page for more than 200 pages, plus the actual expense of postage. Iowa Admin. Code r. 876-8.10(85,86)

The records and images must be provided within 30 days of receipt of the written request. The medical provider may also charge $10 for certified records. Iowa Code § 622.10(6).

Kansas: No state law limits the costs of providing copies of medical records since Kansas Statutes Annotated § 65-4971(b) was repealed by the 2011 Kansas Legislature. Thus, the HIPAA language governs, allowing for “reasonable” cost-based fees. Copies of the records shall be furnished within 30 days of the receipt of the authorization. K.S.A. § 65-6836.

Kentucky: One free copy of a patient’s medical records upon the patient’s written request. A copying fee of $1 per page may be charged “for furnishing a second copy of the patient’s medical record upon request either by the patient or the patient’s attorney or the patient’s authorized representative.” Kentucky Revised Statutes § 422.317.

Louisiana: 50¢ per page for the first 5 pages and 25¢ for each additional page for “any records that are necessary to support [a patient’s] filing for Social Security disability benefits or Supplemental Security Income benefits under any provision of the Social Security Act.” The statute also stipulates that “the amount due shall not be less than the amount paid by the Department of Children and Family Services [DCFS] for such copies,” but unfortunately, the DCFS rate is not publicly available. Records should be provided in “a reasonable period of time, not to exceed fifteen days following the receipt of the request and written authorization.” Louisiana Revised Statutes § 46:18.

Maine:

Hospitals: For paper copies, $5 for the first page and 45¢ for each additional page, up to a maximum of $250 for the entire medical record. “The hospital may require payment prior to responding to the request.” For electronic copies, the hospital may charge “reasonable actual costs of staff time to create or copy the medical record and the costs of necessary supplies and postage,” not to exceed $150. “Actual costs may not include a retrieval fee or the costs of new technology, maintenance of the electronic record system, data access or storage infrastructure.” Maine Revised Statutes, Title 22, Subtitle 2, Part 4, Chapter 401, § 1711.

Doctors: For paper copies, $5 for the first page and 45¢ for each additional page, up to a maximum of $250 for the entire treatment record or medical report. For electronic copies, the doctor may charge “reasonable actual costs of staff time to create or copy the treatment record or medical report and the costs of necessary supplies and postage,” not to exceed $150. “Actual costs may not include a retrieval fee or the costs of new technology, maintenance of the electronic record system, data access or storage infrastructure.” Maine Revised Statutes, Title 22, Subtitle 2, Part 4, Chapter 401, § 1711-A.

Maryland: No charge for medical records “that will be used for the purpose of filing a claim regarding or appealing a denial of Social Security Disability Income or Social Security Benefits under Title II or Title XVI of the Social Security Act” when requested by the patient, the patient’s personal representative, or “an employee or other representative of a nonprofit legal services entity or other volunteer or nonprofit program representing the patient.” Code of Maryland, Health–General § 4-304(c)(5).

For all other requests, paper copies will cost 76¢ per page plus the actual cost for postage and handling. Additionally, a medical provider may charge a $22.88 retrieval and preparation fee (unless the records are provided directly to the patient per federal HIPAA regulations). For electronic copies, 57¢ per page (75% of the per page charge for paper copies), not to exceed $80, plus the actual cost for postage and handling. Additionally, a medical provider may charge a $22.88 retrieval and preparation fee (unless the records are provided directly to the patient per federal HIPAA regulations). Code of Maryland, Health–General § 4-304(c)(3).

Massachusetts:

Hospitals & Clinics: No charge for medical records requested by “any applicant, beneficiary or individual representing said applicant or beneficiary… for the purpose of supporting a claim or appeal under any provision of the Social Security Act,” upon presentation of “reasonable documentation” showing that the records are being requested for this purpose. The hospital or clinic must furnish the records within 30 days. Massachusetts General Laws, Chapter 111, § 70.

Doctors: No charge for medical records requested by “any applicant, beneficiary or individual representing said applicant or beneficiary if the record is requested for the purpose of supporting a claim or appeal under any provision of the Social Security Act,” upon presentation of “reasonable documentation” showing that the records are being requested for this purpose. Code of Massachusetts Regulations, Title 243, § 2.07(13)(d).

Michigan: One free copy of a patient’s medical records for “a medically indigent individual.” Any additional or other requests are subject to an initial fee of $30.60 per request, plus $1.53 per page for the first 20 pages, 77¢ per page for pages 21-50, and 31¢ per page for pages 51+. A medical provider cannot charge a patient the “initial fee” for his/her own medical records. Michigan Compiled Laws § 333.26269. See also State of Michigan Department of Health and Human Services, 2023 MEDICAL RECORDS ACCESS ACT FEES (In Accordance with the Consumer Price Index).

Minnesota: A $10 retrieval fee (and no per page fee) for “copies of records requested by a patient or the patient’s authorized representative if the request for copies of records is for purposes of appealing a denial of Social Security disability income or Social Security disability benefits under title II or title XVI of the Social Security Act.” But a medical provider cannot even charge the $10 retrieval fee “to a person who is receiving public assistance, who is represented by an attorney on behalf of a civil legal services program or a volunteer attorney program based on indigency.” For further appeals, “a patient may receive no more than two medical record updates without charge, but only for medical record information previously not provided.” Minnesota Statutes § 144.292, subdivision 6, paragraph (d).

Mississippi: $20 total for pages 1-20, $1 per page for the next 80 pages, and 50¢ per page for any additional pages. A medical provider may add 10% of the total charges for postage and handling. Also, an extra $15 can be charged for retrieval of records stored offsite. Mississippi Code Annotated § 11-1-52(1).

Missouri: For paper copies, a $28.70 search and retrieval fee, plus 66¢ per page. An extra $26.87 can be charged for retrieval of records stored offsite. For electronic copies, a $28.70 search and retrieval fee, plus 66¢ per page, or $125.78 total, whichever is less. Additionally, a medical provider may charge postage, to include packaging and delivery cost, and a $2 notary fee, if requested. Missouri Revised Statutes § 191.227. See also Missouri Department of Health and Senior Services, Fees for Medical Records.

Montana: $15 administrative fee for searching and handling, plus 50¢ per page for paper copies. Montana Code Annotated § 50-16-540.

Nebraska: No charge for medical records requested by a patient for use in supporting an application for disability benefits or an appeal relating to the denial of such benefits under Title II, Title XVI, or Title XVIII of the Social Security Act. The request must also include a statement or document from the Social Security Administration that confirms the application or appeal. Nebraska Revised Statute § 71-8405.

Nevada: One free copy of a patient’s medical records “necessary to support a claim or appeal under any provision of the Social Security Act… if the request is accompanied by documentation of the claim or appeal.” A copying fee of 60¢ per page plus “a reasonable cost for copies of x-ray photographs and other health care records produced by similar processes” may be charged for furnishing a second copy of the patient’s records to support the same claim or appeal. “No administrative fee or additional service fee of any kind may be charged for furnishing such a copy.” Notably, a medical provider cannot deny furnishing a copy of the records “solely because the patient is unable to pay the [applicable] fees.” The records must be provided within 30 days of receipt of the request. Nevada Revised Statutes § 629.061(5).

New Hampshire: $15 total for the first 30 pages or 50¢ per page, whichever is greater. However, a medical provider may charge a “reasonable cost” for providing copies of “filmed records,” including radiograms, x-rays, and sonograms. New Hampshire Revised Statutes, Title XXX, § 332-I:1.

New Jersey: No charge for medical records requested by a patient or an attorney representing a patient who has a pending application for, or is currently receiving, Social Security disability benefits provided under Title II or Title XVI of the Social Security Act. The records must be delivered in the manner specified by the requestor within 30 days of the request. New Jersey Revised Statutes § 26:2H-5n and New Jersey Revised Statutes § 45:9-22.27.

New Mexico: $2 per page for the first 10 (one-sided) pages, 20¢ per page for each additional page. All requests for medical records needed to support a Social Security disability application or appeal must be accompanied by a written verification of the application or appeal. Regardless of whether the applicable fees have been paid, the medical provider must produce the records within 30 days of receipt of the written request. New Mexico Administrative Code § 7.1.10.8B-10.

New York: No charge for medical records if requested “for the purpose of supporting an application, claim or appeal for any government benefit or program…” If the medical provider maintains records in electronic format, it will provide copies “in either electronic or paper form, as required by the government benefit or program, or at the patient’s request.” New York Public Health Law § 17.

North Carolina: 75¢ per page for the first 25 pages, 50¢ per page for pages 26-100, and 25¢ per page for each page over 100, with a minimum fee of $10. North Carolina General Statutes § 90-411.

North Dakota: For paper copies, $20 total for the first 25 pages, plus 75¢ per page for each additional page. For electronic copies, $30 total for the first 25 pages, plus 25¢ per page for each additional page. North Dakota Century Code § 23-12-14.2.

Ohio: One free copy of a patient’s medical records, plus one free copy of any updated records (excluding copies of records already provided), to a patient or his/her personal representative or authorized person “if the medical record is necessary to support a claim under Title II or Title XVI of the Social Security Act.” The request must be accompanied by documentation that a disability claim has been filed. Ohio Revised Code § 3701.741(C)(1)(e).

Oklahoma: For paper copies, 50¢ per page. For electronic copies, 30¢ per page plus delivery fees, not to exceed a combined total of $200. If an attorney requests the records, the medical provider may charge an additional $20 base fee (even if the search yields no records), plus postage or delivery fees. Each printed x-ray, other photograph, or image costs $15 plus $20 per CD/DVD or other electronic media that it is provided on. The medical provider may also charge $15 for certified records. However, a medical provider cannot charge a patient requesting his/her own records any fees for “searching, retrieving, reviewing, and preparing medical records.” Oklahoma Statutes § 76-19(A)(2).

Oregon: One free copy of a patient’s medical records for the period from the date of the alleged onset of disability to the date of the administrative hearing to support an appeal of the denial of Social Security disability benefits to the claimant or his/her personal representative in either paper or electronic format. Oregon Revised Statutes § 192.576.

Pennsylvania: A flat fee of $35.50 plus the actual cost of postage, shipping or delivery for the production of records “requested for the purpose of supporting a claim or appeal under any provision of the Social Security Act.” The medical provider must be given “clear and convincing documentation” that the records are necessary to support a Social Security claim or appeal. Pennsylvania Consolidated Statutes, Title 42, Chapter 61, § 6152.1. See also Amendments to Charges for Medical Records.

Puerto Rico: Every provider shall provide all patients “with a speedy access to their files and records. Patients are entitled to receive a copy of their medical record.” There is no further law limiting the costs of providing copies of medical records, except that “whenever any of the parties, to wit the medical services provider or the patient, concludes the physician-patient relationship, said medical record shall be furnished to the patient, father, mother, or custodian free of charge, within a term that shall not exceed five (5) working days. The fact that an outstanding debt exists between the physician and the patient shall not be an impediment for the patient to obtain his/her medical record.” P.R. Laws tit. 24, §3049.

Rhode Island: No charge for medical records furnished to a patient or his/her attorney or representative if “necessary for the purposes of supporting an appeal under any provision of the Social Security Act,” and the request is accompanied by documentation of the appeal. The medical provider must furnish the records within 30 days of receipt of the request. Rhode Island General Laws § 23-17-19.1(16).

South Carolina: For paper and electronic copies, 83¢ per page for the first 30 pages, 63¢ per page for each additional page, plus a $32.06 clerical fee. For paper copies, altogether these fees cannot exceed $256.58, and for electronic records, these combined fees cannot exceed $192.44. Actual postage and applicable sales tax may also be charged. The search and handling fees are permitted even when no medical record is found as a result of the search, except where the request is made by the patient.

For copies of x-rays, the hospital may charge the actual cost of reproduction, including the cost of materials and supplies used to duplicate the x-ray and the labor and overhead costs associated with the duplication. The provider must furnish the records no later than 45 days after the patient’s discharge or 45 days after the request is received, whichever is later. South Carolina Code of Laws § 44-7-325 and South Carolina Code of Laws § 44-115-80; see also The Department of Health and Environmental Control (DHEC), ANNUAL ADJUSTMENT TO THE FEE FOR SEARCH AND DUPLICATION OF A MEDICAL RECORD.

South Dakota: For paper copies, $10 for the first 10 pages and 33¢ for each additional page. For electronic copies, 25¢ per page. For a printed copy of an x-ray, MRI, or other form of medical imaging, a fee not to exceed $10, and for an electronic copy of the same, a fee not to exceed $15. The provider may also charge the cost of postage, shipping, and any applicable tax. South Dakota Codified Laws §36-2-16.4.

Tennessee:

Hospitals: No charge for medical records for an “indigent person” to support a claim or appeal under any provision of the Social Security Act, if the request is accompanied by a copy of a recent application for or decision denying Social Security benefits. “Patients being represented by organizations whose purpose is to provide legal assistance to the indigent, or represented by attorneys with an affiliated pro bono program, shall be presumed indigent.” Those represented by others may be required to provide proof of indigency, which can be done with this form. The hospital must furnish the records within 30 days of the request.

For non-indigent patients, the hospital may charge an $18 fee, which includes the first 5 pages, and a per page charge of 85¢ for pages 6-50, 60¢ per page for pages 51-250, and 35¢ per page for each page after that. The hospital may also charge $20 for each certified record. Tennessee Code Annotated § 68-11-304.

Doctors: effective July 1, 2024, non-hospital medical providers in Tennessee can only charge a flat fee of twenty dollars ($20) for an electronic copy of medical records requested by anyone other than the patient for “patients involved in a claim or appeal of denial for social security disability benefits.” Requests for paper records will continue to incur additional costs. (TN Public Chapter No. 737).

Texas: One free copy of a patient’s medical records, including mental health records, requested by a patient, former patient, or his/her attorney or “other authorized representative” for use in supporting an application for or appeal of disability benefits under Title II, Title XVI, or Title XVIII of the Social Security Act. If additional information is added to the patient or former patient’s record, upon request, the provider will supplement the record provided free of charge. The request must also include documentation from the Social Security Administration confirming the application or appeal. Texas Health & Safety Code § 161.202. See also Texas Administrative Code Rule §165.2(k).

Utah: One free copy of a patient’s medical records if the request “is accompanied by documentation of a qualified claim or appeal” for benefits under any provision of the Social Security Act. “[F]or a second or subsequent copy in a calendar year of a date of service that is necessary to support the qualified claim or appeal,” the medical provider may charge 60¢ per page for paper copies and no more than the allowable amount in Subsection (8)(c) for electronic copies (maximum of $150). The records must be provided within 30 days of receipt of the request. Utah Code § 78B-5-618(10).

Vermont: No charge for medical records “requested to support a claim or an appeal under any provision of the Social Security Act.” Vermont Statutes Annotated, Title 18, § 9419(a).

Virginia: If a patient requests a copy of his/her own records, a medical provider may charge a “reasonable cost-based fee,” which can only include the cost of supplies for and labor of copying the requested information, postage, and preparation of an explanation or summary of such information as agreed to by the patient. Code of Virginia § 32.1-127.1:03(J).

If an attorney requests a copy of the patient’s records, for paper copies, a medical provider may charge 50¢ per page up to 50 pages and 25¢ per page for each additional page, plus a $20 search and handling fee and all postage and shipping costs. These costs do not apply to hard copies from microfilm or other micrographic process, which cost $1 per page. For electronic copies, a medical provider may charge 37¢ per page up to 50 pages and 18¢ per page for each additional page, plus a $20 search and handling fee and all postage and shipping costs, not to exceed a total of $160. These costs do not apply to electronic copies of x-rays, which cost a “reasonable fee” of $25 per x-ray, plus a search and handling fee of $10 and all postage and shipping costs. The patient’s attorney must provide the medical provider with a written confirmation signed by the patient confirming the attorney’s authority to make the request (a photocopy, facsimile or other copy of the original signed by the patient is acceptable). The medical provider must furnish the records within 30 days of receipt of the request and production of the records cannot be withheld or delayed solely on the grounds of nonpayment. Code of Virginia § 8.01-413(B).

Washington: One free copy of a patient’s medical records every two years “if the patient is appealing the denial of” SSI or Social Security disability benefits and the request is made by a patient or his/her “personal representative.” Beyond the free copy, a provider may charge a “reasonable fee.” Revised Code of Washington § 70.02.030(2)(b).

West Virginia: One free copy of a patient’s medical records for an “indigent person” if necessary to support a claim or appeal under any provisions of the Social Security Act. Patients are considered indigent if they are “represented by an organization or affiliated pro bono program that provides legal assistance to indigents; or verifies on a medical records request and release form that the records are requested for purposes of supporting a Social Security claim or appeal and submits with the release form reasonable proof that the person is financially unable to pay full copying charges by reason of unemployment, disability, income below the federal poverty level, or receipt of state or federal income assistance.”

For non-indigent patients or additional patient requests from the same medical provider, the medical provider may charge “a fee consistent with HIPAA” not to exceed 40¢ per page, a $20 search and handling fee, and any actual mailing costs and applicable taxes. For electronic records, the fees cannot exceed $150, inclusive of all fees, except for applicable taxes. A provider can charge $10 if a certified copy is requested. West Virginia Code § 16-29-2.

Wisconsin: If a patient or his/her authorized representative requests medical records for use in appealing the denial of a Social Security disability insurance or Supplemental Security Income claim, the medical provider cannot charge “more than the amount that the federal Social Security Administration reimburses the department for copies of patient health care records.” Wisconsin Statutes § 146.83(1f)(am). See also 20 C.F.R § 401.95, showing a current SSA reimbursement rate of 10¢ per page, with the caveat that there is no charge if the total amount of copying does not exceed $25.

Wyoming: A medical provider may charge “reasonable charges, and charge a patient for the actual costs incurred in responding to a patient’s request” for medical records, including “the cost of copies, clerical staff time and the physician’s time in reviewing and summarizing the records and/or x-rays and diagnostic records, if necessary.” However, a medical provider cannot deny a patient a summary or copy of his/her medical records because of an inability to pay. Wyoming Administrative Rules, Board of Medicine, Chapter 3: Practice of Medicine, § 4(e).

HIPAA: The Privacy Rule permits a medical provider to impose a “reasonable, cost-based fee,” which may include only the cost of labor for copying the requested records, whether in paper or electronic form; supplies for creating the paper copy or electronic media (e.g., CD or USB drive); postage, when records are requested to be mailed; and preparation of an explanation or summary of the medical records, if agreed to by the patient. 45 CFR § 164.524(c)(4). The fee may not include costs associated with verification, documentation, search and retrieval, maintaining systems, recouping capital for data access, storage, or infrastructure, or other costs not listed above, even if such costs are authorized by state law. See also U.S. Department of Health & Human Services, Individuals’ Right under HIPAA to Access their Health Information 45 CFR § 164.524. However, “the fee limitation set forth at 45 C.F.R. § 164.524(c)(4) apply only to an individual’s request for access to their own records, and does not apply to an individual’s request to transmit records to a third party.” U.S. Department of Health & Human Services, Important Notice Regarding Individuals’ Right of Access to Health Records.

HITECH Act: Under the Health Information Technology for Economic and Clinical Health (HITECH) Act, health care providers that maintain electronic medical records, excluding psychotherapy records, are required to provide them to the patient for the actual cost of production within 30 days of the written request. The request must be signed by the patient indicating that it is a patient’s request for medical records. After the U.S. District Court for the District of Columbia found that the “Patient Rate” is not applicable to an individual’s request for his/her medical records to be sent to a third party in Ciox Health, LLC v. Azar, et al., No. 18-cv-0040 (D.D.C. January 23, 2020), HHS issued an “Important Notice Regarding Individuals’ Right of Access to Health Records” explaining that the fee limitations “will apply only to an individual’s request for access to their own records, and does not apply to an individual’s request to transmit records to a third party.”

21st Century Cures Act: The Interoperability, Information Blocking, and the ONC Health IT Certification Program final rule implements certain provisions of the 21st Century Cures Act. 85 Fed. Reg. 25642 (May 1, 2020). The regulations, specifically 45 CFR § 171.302, explain when a medical provider may still charge for “accessing, exchanging, or using” electronic health information (EHI) and make clear that providers cannot charge “[a] fee based in any part on the electronic access of an individual’s EHI by the individual, their personal representative, or another person or entity designated by the individual [emphasis added].” See § 171.302(b)(2). However, the regulation defines “electronic access” as an “internet-based method that makes electronic health information available at the time the electronic health information is requested and where no manual effort is required to fulfill the request [emphasis added].” See § 171.302(d). See also www.healthit.gov/curesrule/faq/if-individual-asks-actor-provide-copy-individuals-electronic-health-information-ehi-some-form. These rules, specifically 45 CFR § 171.102, exclude psychotherapy notes and “[i]nformation compiled in reasonable anticipation of, or for use in, a civil, criminal, or administrative action or proceeding” from the definition of EHI.

Overpayments: Report positive SSA customer service

Commissioner O’Malley has been working hard to shift SSA’s culture to one that routinely provides quality customer service. With the recently announced improvements on overpayments, the Commissioner is interested in celebrating his employees who are following his lead.

When dealing with your overpayment cases, if you encounter an SSA representative who is clearly trying to implement the new policies in a hassle-free way, please complete this survey so that we can report this positive progress to the Commissioner. It is our hope that once employees start to realize that those providing quality interactions are celebrated, others will follow suit, thus providing a better experience for all.

Vocational Determinations and the State Agency: The DOT is Not Just a Problem at the Hearing Level

Tom Krause, Litigation Director

Over the past several years, NOSSCR and its members have consistently complained of SSA’s use of the antiquated Dictionary of Occupational Titles (DOT). NOSSCR recently completed a three-part series online regarding Vocational Expert Cross-Examination. There will be multiple sessions at the Nashville Conference on Vocational Experts and the DOT. But what about DDS vocational determinations on initial application and reconsideration?

Nationally, in FY 2023, the various state agencies decided about 1.8 million initial applications and almost a half-million requests for reconsideration. While hard figures are hard to find, and since the Field Office issues Step 1 denials, we believe the great majority of these decisions are based on vocational factors. But are these vocational determinations any more sound than vocational expert testimony at a hearing? Apparently not. Below is an example drawn from a recent file review. Not only did the state agency mess up, but it messed up badly. Here are the facts and analysis, followed by the DOT descriptions for the three jobs identified:

The claimant is 48 years old, born in late 1975 with a twelfth-grade education. DDS did not make a finding regarding past relevant work.

The claimant’s impairments include chronic lumbar back pain; traumatic complete tear of the right rotator cuff, sequela; right shoulder glenohumeral synovitis; shoulder biceps tenosynovitis; shoulder supraspinatus/infraspinatus tear; shoulder impingement with down sloping acromion; anemia; menorrhagia; abnormal uterine bleeding; symptomatic fibroids, chronic pelvic pain; myofascial pain; and more.

According to DDS, the claimant was able to stand and/or walk about 6 hours a day; sit for about 6 hours a day with normal breaks; occasionally lift and/or carry 20 pounds; frequently lift and/or carry 10 pounds; occasional overhead reaching; and avoid concentrated exposure to hazards.

DDS determined the claimant could perform these occupations:

- Page (radio & television) 353.367-022

- Clocker (amusement & recreation) 153.367-010

- Counter Clerk (photofinishing) 249.366-010 DDS did not give numbers for these jobs.

According to Job Browser Pro:[1]

| Page (radio & television), DOT No. 353.367-022 | 0 |

| Clocker (amusement & recreation), DOT No. 153.367-010 | 6 |

| Counter Clerk (photofinishing), DOT No. 249.366-010 | 868 |

So, for 3 occupations, there are 874 jobs total. These numbers do not consider the number of jobs considered as full-time by the BLS (35-39 hours/week) that are not consistent with SSA’s concept of residual functional capacity (8 hours/day, 5 days/week or equivalent) or the jobs that require standing and/or walking more than 6 hours per day. Cf. SSR 96-8p, DOT, App. C.

More specifically, these limited numbers may be exaggerated. For example, the Counter Clerk (photofinishing) job is obsolete as described in the DOT (e.g., selling camera flashbulbs and flashcubes).

In short, the gross number of jobs for the occupations identified by DDS is not a significant number of jobs and even that minuscule number exaggerates the number of jobs realistically available to the claimant.

OK. We already suspected the vocational determinations from the state agencies were bogus. Now we can prove it. So what do we do about it? Stay tuned; we will have more information on this issue next month.

The DOT descriptions for these jobs follow:

- Page, DOT No. 353.367-022: Conducts visitors on tours of radio and television station facilities and explains duties of staff, operation of equipment, and methods of broadcasting. Utilizing general knowledge of various phases of radio and television station operations. Runs errands within studio. May relieve telephone switchboard operator. May perform general clerical duties such as taking messages, filing, and typing.

- Clocker (amusement & recreation), DOT No. 153.367-010: Clocks (times) racehorses at racetrack during morning workouts to obtain speed information: Identifies each horse on track by its particular identifying marks and color, and records name. Observes horse during workout and assigns speed rating according to effort extended by horse and rider, distance run, and time required as measured by stopwatch. Records information and submits it to track management.

- Counter Clerk (photofinishing), DOT No. 249.366-010: Receives film for processing, loads film into equipment that automatically processes film for subsequent photo printing, and collects payment from customers of photofinishing establishment: Answers customer’s questions regarding prices and services. Receives film to be processed from customer and enters identification data and printing instructions on service log and customer order envelope. Loads film into equipment that automatically processes film, and routes processed film for subsequent photo printing. Files processed film and photographic prints according to customer’s name. Locates processed film and prints for customer. Totals charges, using cash register, collects payment, and returns prints and processed film to customer. Sells photo supplies, such as film, batteries, and flashcubes.

[1] Job Browser Pro numbers are not definitive. We use these numbers as a matter of convenience. Cf. EM-21065 REV (eff. 12/5/2023).

Legislative Spotlight

Betsy Osborn, NOSSCR Government Relations Director

On April 16, 2024, Sen. Bob Casey (D-PA), Sen. Tim Kaine (D-VA), and Sen. Tammy Baldwin (D-WI) introduced S. 4120, the Long-Term Care Workforce Support Act. The bill has 22 additional cosponsors, 20 Democrats and 2 Independents.

This legislation seeks to improve shortages in the long-term care workforce by increasing the number of direct care professionals in rural areas, improving compensation for these professionals, and improving the quality of long-term care for families, among other things. NOSSCR supports this legislation.

Are 30,000 people still using this flash cube? Thankfully the Eastern District of New York says ‘NO’

Sharmine Persaud, NOSSCR Sustaining Member

In the past few years one particular District Court Judge in the Eastern District of New York has issued numerous decisions highlighting SSA’s reliance on obsolete jobs. His decision in Wagner caught my attention—inserted on the first page of the memorandum of decision & order was a color image of an antiquated camera and flash cube. I recall my father owned such a camera in the seventies; it was a big clunky item, whereby he would have to get close enough to take the picture, press a button to ignite the flashcube, temporarily blinding my siblings and me. Those were the good old days.

According to vocational witnesses and SSA, the job of photo finishing counter clerk is alive, well, and available in significant numbers. Thankfully, the court in Wagner disagreed. That case involved a firefighter who was severely injured in the line of duty when he sustained a fifteen-foot fall, leading to repeat spinal fusion operations. The ALJ determined he could not return to his past relevant work, nor could he perform light work. However, the ALJ hypothetical created an opening for the vocational witness to cite to three unskilled, simple, sedentary jobs: 1) photo finishing counter clerk, 249.366-010, 2) a children’s attendant, 349.677-018, and 3) an attendant in a tanning salon, 359.567-010.

The Court in Wagner wasted no words in condemning the ALJ for “unblinking acceptance of conclusory opinions by vocational expert testimony,” particularly that “predicated on plainly obsolete positions.” The Court went on to cite prior decisions resulting in remands where the ALJ relied on the existence of ‘document preparer’ jobs where the “vocational expert dubiously opined that 35,000 such positions await those who care to plunge into production of microfilmed records” Feuer v. Saul, 2019 WL 9042872, at *1 (E.D.N.Y. 2019), report and recommendation adopted, 2020 WL 1316528 (E.D.N.Y. 2020).

The court concluded that these jobs and the ones cited by the vocational witness are obsolete—

The notion that there are opportunities waiting for this plaintiff to work as a photo finishing counter clerk belies all common sense. The ubiquity of smartphones with built-in digital cameras has consigned consumer film processing to the most niche of markets: by one estimate in 2015, there were only 190 photo development shops left in the United States. Thus, the photo finishing counter clerk has gone the way of the VCR movie rental clerk or a carbon paper salesperson, and testimony about such archaic posts have no place in determining important rights of our citizenry.

Wagner v. SSA, 21-CV-3627(GRB) EDNY, decided August 12, 2022.

This was a good decision for Wagner and claimant’s attorney. Many courts have been issuing decisions like these and we, as attorneys, have to keep the momentum going by pushing back at hearings when the vocational witnesses cite obsolescence.

This is a guest column provided by a NOSSCR member. The views expressed in this column are the views of the author alone, and do not represent the views of NOSSCR, NOSSCR’s leadership, or NOSSCR’s staff.

It’s not too late to join us in Nashville!

We can’t wait to see those of you who have already registered – and for anyone who hasn’t yet, it’s not too late! Register now to join us Wednesday May 8th through Saturday May 11th!

Here’s a sneak peek at the tentative schedule:

SSA’s Proposed Rule on the use of payroll data generates numerous comments

SSA submitted a Proposed Rule on February 15, 2024 regarding the use of electronic payroll data to improve program administration. NOSSCR submitted official comments to that proposal, and those comments can be read below.

Many other individuals and organizations submitted comments on the proposed rule, including the House of Representatives’ Committee on Ways and Means, whose comments can also be read below.

We will continue to monitor the progress of this rule and will update our membership on the final language when it becomes available.

Help Your Clients Obtain All Available Benefits: Know ERISA Time Limits & Beware of the Closed Record Rule

Kaitlyn Barciszewski

As an advocate for clients with disabilities it is important to know about other benefits they may be eligible for. Often, your disabled client will also have a claim for benefits under an individual disability income (IDI) or group long-term disability (LTD) policy that they need to apply for. Whether you are a social security attorney interested in learning how to help your client obtain these benefits or you prefer to only handle their social security claim, you should be aware of certain regulatory time limits and other rules that apply to your client’s private disability claims. Knowing the basic timelines and rules applicable to disability insurance claims could save your client from missing the critical evidence-gathering stage altogether.

For this article, I will cover some of the rules applicable to disability claims governed under ERISA, which includes almost all group-disability plans obtained through non-governmental and non-church employers.[1] Knowing when the record closes for an ERISA case and what time limits apply will ensure that you provide your client advice that will help protect their claim for ERISA disability benefits. It is important to understand the deadlines imposed by ERISA because the insurance company will deliberately downplay the following information or misinform your client about their rights.

It’s Too Late to Gather Evidence Once the Insurance Company Issues a Final Denial

The time to prove eligibility for LTD benefits is during the administrative level before an insurance company or plan administrator issues a final denial. Often it is not a good idea for a claimant to handle their ERISA appeal on their own and then hire an attorney after a final denial because of the “closed record” rule. Although not set out in ERISA or its implementing regulations, this court-created rule strictly mandates that the ERISA record, the record the court ultimately reviews to make its decision, closes when the claim administrator issues a final decision. There are only a few very limited exceptions to this “closed record” rule that vary from circuit to circuit. Thus, it is important to ensure that all evidence is submitted on appeal before a final denial is issued. Most claimants are unaware of the “closed record” rule and do not submit adequate evidence for an attorney to take their case to court. Therefore, hiring an attorney early in the appeal process is best to ensure that all the applicable evidence is submitted and included in the ERISA record.

Not only do you want to make sure that your client has submitted all the evidence before the ERISA record closes, but you want to make sure that your client is also submitting the proper responsive evidence to make sure they have a good court case. The often-applicable discretionary standard of review is a related reason why it is crucial to build a strong record during the administrative appeals stage and not wait for some non-existent later opportunity to show why the insurance company was unreasonable.

Because of the Supreme Court’s decision in Firestone Tire & Rubber Co. v. Bruch, the standard of review that applies in most cases under ERISA is the arbitrary and capricious standard of review. 489 U.S. 101, 111(1989). Under this deferential standard, courts will uphold a benefit determination only if it is “rational in light of the plan’s provisions.” Univ. Hosps. of Cleveland v. Emerson Elec. Co., 202 F.3d 839, 846 (6th Cir. 2000) (internal quotations and citations omitted). Because of the broad deference courts must give to the denial decision under this standard, developing quality evidence during the administrative stage is critical to increasing odds of litigation success.

Because the ERISA record closes at the time of the final denial and the court may review the case under an arbitrary and capricious standard of review, make sure that your client has submitted all the necessary and responsive evidence before a final denial is issued or that they have an ERISA attorney on their side ensuring the correct evidence is submitted.

Know Administrative Time Limits to Make the Most of the Evidence-Gathering Stage

Knowing the time limits that apply to ERISA claims during the administrative level will help you advise clients accurately and know when it makes the most sense for them to obtain experienced legal help. The ERISA regulations set most of the relevant time limits. ERISA empowers the Department of Labor to make regulations as necessary to govern the claims administration process. The procedural rules for insurance claims governed under ERISA are located at 29 C.F.R. § 2560.503-1 and were last updated in 2018. The updated regulations provide more relief and guidance for claimants than their predecessors, but if a deadline is missed, usually the case cannot move forward.

As a social security attorney, it is best to ask your client if they have a claim for long term disability benefits as early as possible. If your client is only in the beginning application stage of their LTD claim, you should inform your client that they should review the deadlines in their plan to ensure that they are not missing any application deadlines. The regulations allow the LTD policy or plan to set the time limit for when a claimant must submit a request for benefits. See 29 C.F.R. § 2560.503-1(e) (“a claim for benefits is a request for a plan benefit or benefits made by a claimant in accordance with a plan’s reasonable procedure for filing benefit claims.”). Usually, plans require claimants to submit proof of disability no later than 30 days after the date of the loss on which the claim is based. But because the plan controls, it is important to check the plan’s time limits for submitting a claim as soon as possible as the time limits can be short.

If your client has received an initial denial of LTD benefits, there are several time limits and procedural rules that become relevant to your client. This is the best time for your client to obtain an experienced ERISA attorney’s help with appealing the denial before the ERISA record closes.

Once an initial denial is issued, the claim regulations establish minimum time limits that an insurance company must provide a claimant to appeal. If a claimant does not appeal within the time limits, her claim will likely be denied for failure to exhaust administrative remedies. According to 29 C.F.R. §§ 2560.503-1(h)(3)(i) and (4), a claimant must be given at least 180 days to appeal. A common and unfortunate reality is that claimants often rush to submit an appeal after being told by the insurance company that it is a simple re-evaluation process, that they can just fill out a provided appeal form, etc. This could be fatal because the claim administrator could issue a final denial before any evidence supporting the appeal is submitted.

After an “appeal” is submitted (even if it is just a hand-written letter saying, “I appeal”), the claim regulations mandate that the insurance company must make a decision on appeal within 45 days, which can be extended an additional 45 days if special circumstances exist. §§ 2560.503-1(i)(1)(i) and (3).[2] If the decision is not made on time, it is “deemed exhausted” and the claimant may then file a lawsuit to pursue any available remedies under section 502(a) of ERISA on the basis that the plan has failed to provide a reasonable claims procedure that would yield a decision on the merits of the claim. § 2560.503-1(l).

Despite the 180-day appeal deadline and 45-90-day decision deadlines established by the regulations, the 2018 amendments require an opportunity be granted to the claimant to review and respond to any new evidence and/or rationales generated by the insurance company on appeal. While the regulations state that such evidence and/or rationale “must be provided as soon as possible and sufficiently in advance of the date on which the notice of adverse benefit determination on review is required … to give the claimant a reasonable opportunity to respond prior to that date”, the reality is that what counts as a “reasonable opportunity” is undefined and often, insurers provide very short deadlines to claimants who do not know to ask for extensions. § 2560.503-1(h)(4). Courts are just now starting to address this issue and further define what amount of time is considered “reasonable.” See, e.g., Walker v. AT&T Benefit Plan No. 3, No. 2:21-CV-00916-MCS-SK, 2022 WL 1434668, at *5 (C.D. Cal. Apr. 6, 2022), aff’d, No. 22-55450, 2023 WL 3451684 (9th Cir. May 15, 2023) (“Here, a five day period to respond to two new Transferable Skill Assessments is not reasonable.”). Knowing that insurance companies are giving such short time periods to exercise this new right, it’s important to keep in mind that many unrepresented claimants may not be benefiting from the full protections established by the 2018 regulation amendments.

The opportunity to review and respond to new rationale and evidence generated by the insurance company is a major improvement provided by the 2018 amendments. It provides claimants with one last shot to prove their entitlement to LTD benefits with new evidence, usually in the form of doctor or expert responses to the insurance company’s conclusions. But without knowing that it is their last opportunity to add evidence to the record, or that they can ask for more time than the unreasonable amount granted by the insurer, unrepresented claimants often miss this crucial opportunity and right granted by the updated regulations. An experienced ERISA attorney would help ensure that the new regulatory protections are taken full advantage of to increase the odds of a successful appeal or case in court.

Knowing the rules that work against claimants with LTD claims falling under ERISA and the time limits that apply during the administrative stage, here is a list of mistakes that you can help your client avoid:

Mistakes to Avoid:

- Failing to submit all the information to support a claim as part of the appeal process. Because the record closes when a “final denial” (usually the second denial) is issued by the insurance company, claimants cannot usually add new evidence to support the claim after the claim has been denied for the final time.

- Assuming that medical records are enough to show that a claimant is disabled. Many clients who appeal on their own tell us, “but I submitted all my medical records!” That is usually not enough. Instead, gather documentation of specific restrictions and limitations. An experienced ERISA attorney will have forms that are targeted to obtain this information.

- Missing the opportunity to review and respond to the insurance company’s new rationale or evidence on appeal. Don’t miss the chance to let treating doctors respond to the insurer’s file-reviewing physicians or nurses! And don’t feel like you have to always work within the short deadlines given by the insurance company. Know when to request an extension. This last opportunity is crucial.

- Ignoring the insurance company’s or plan administrator’s deadlines. Sometimes a case is lost, and can never be won, simply because the client missed the appeal deadline contained in the insurance company’s letters and in the plan. Once a deadline is missed, usually the case cannot go forward.

- Waiting until after a claim has been denied a second time before hiring an attorney! To avoid the mistakes listed above, make sure your client hires an experienced ERISA attorney as soon as possible, so that the attorney can help get all the necessary and responsive evidence in the record, and help with other problems that often come up.

How Social Security and ERISA Attorneys Can Work Together to Improve Outcomes for the Client:

- If you refer an ERISA case to an attorney, the best time to do so is usually when the client has received an initial denial from the insurance company. But sometimes, it might make sense to get an ERISA attorney involved at the application stage if the medical facts are particularly complex or the insurance company is taking too long to make a decision.

- Attorneys can share helpful medical records, opinion evidence, and vocational reports. This can reduce the cost for your client by not having to request and pay for medical records and opinions twice.

- Attorneys can share favorable decisions to submit as evidence of disability.

For the reasons stated above, plus many more not included in this article, it is important to help your client identify if they have other benefits that they may be eligible for. One of those benefits is LTD benefits which have quick deadlines under ERISA and a tricky “closed record” rule. It is important to set your client up for success by helping them obtain an ERISA attorney before it is too late and benefits are lost.

[1] For a more detailed discussion on whether ERISA applies to your client’s claim, we have several newsletters that cover this topic on our website at buchanandisability.com.

[2] For a detailed discussion on what counts (and what should not count) as special circumstances, we have newsletters that cover this topic on our website at buchanandisability.com.

This is a guest column. The views expressed in this column are the views of the author alone, and do not represent the views of NOSSCR, NOSSCR’s leadership, or NOSSCR’s staff.

SSA Chief Actuary Steve Goss analyzes SSDI expectations

On April 3, 2024, SSA’s Chief Actuary Steve Goss presented at an Allsup webinar alongside NOSSCR’s CEO David Camp. Goss’ presentation slides on “Social Security Disability Insurance Past Experience and Expectations: Applications, Incidence, and Prevalence Rates Reasons for Change” offer an interesting look at the disability landscape.

Daily dose of data from SSA

Here’s a look at some of the recent statistical and actuarial publications from SSA:

- A monthly snapshot of statistics on Social Security beneficiaries and Supplemental Security Income recipients.

- These monthly tables provide statistics for federally administered payments and awards under the Supplemental Security Income (SSI) program.