The government giveth and, occasionally, taketh away: SSDI and Federal Income Tax

Social Security beneficiaries may have questions about whether their retroactive benefits and/or their ongoing monthly benefits are taxable. This article gives general income tax guidance and should not be used as the basis for tax advice in individual cases. This is a broad overview with examples. This article only analyzes SSDI and not Supplemental Security Income (SSI). The composition of taxable income for each individual is unique and the permutations of taxation are myriad depending on a range of variables including income source, household composition, and timing. This article only concerns federal taxation. Most states do not tax SSDI. However, that is not discussed here.

Though an investment in hiring a tax professional may seem steep for an individual receiving SSDI, it may pay for itself many times over in tax savings or in prevention of emotional and financial disturbance arising from an IRS audit. NOSSCR cannot give tax advice and we recommend that your client always consult a tax professional.

When an individual receives a retroactive payment, SSA is required to send a 1099 form by February 1 of the following year, specifying how much of the Social Security benefit received in the retroactive payment was really a payment for a prior year (or years). The 1099 form also lists the amount of the attorney fee paid. These 1099 forms are often inaccurate, and the taxpayer should double check all numbers with his or her award notice.

The myth

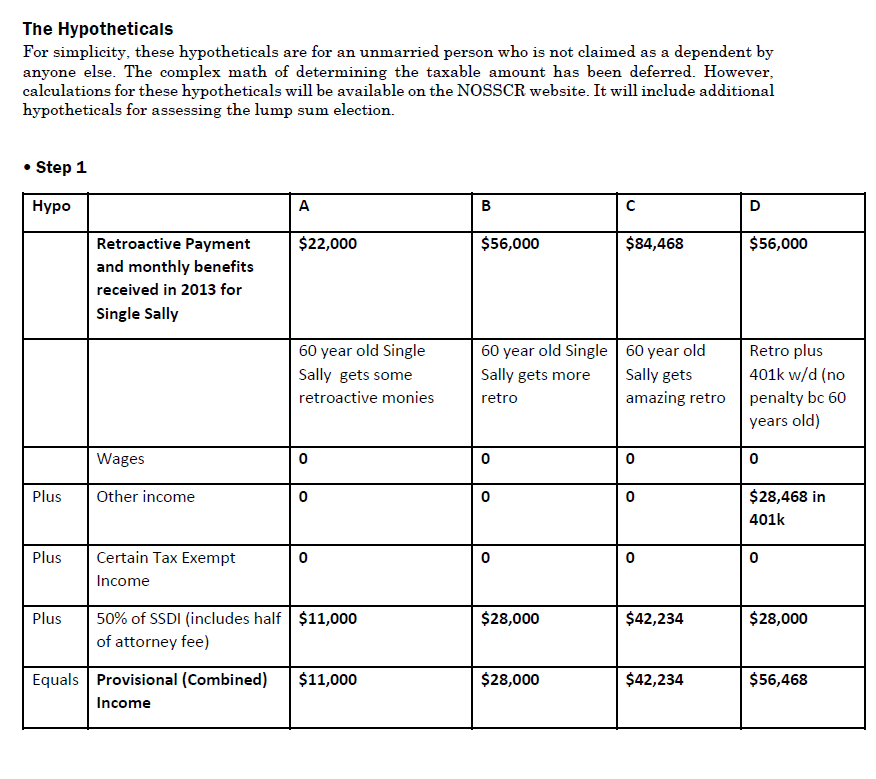

While many of us have heard up to 85% of SSDI benefits are taxable, it is not a frequent occurrence. The 85% figure only applies under certain circumstances, e.g., if a married individual living with his/her spouse is filing a separate tax return, if a non-citizen is living abroad in certain countries, or if there is a significant amount of other income in the household. See IRS Publication 915 (2013), “Social Security and Equivalent Railroad Retirement Benefits.” However, if the only income in the household is SSDI, it is unlikely that it will be taxed at all, even if it is as high as $81,000 (with the inclusion of retroactive payments) for a single person household. If there is a combination of “substantial” wages and/or other income, the non-SSDI may be taxable. See: “Benefits Planner: Income Taxes and Your Social Security Benefits.” In that situation, the non-SSDI portion of income will continue to be taxed normally, and some portion of SSDI often will be taxed as though it was additional earned income.

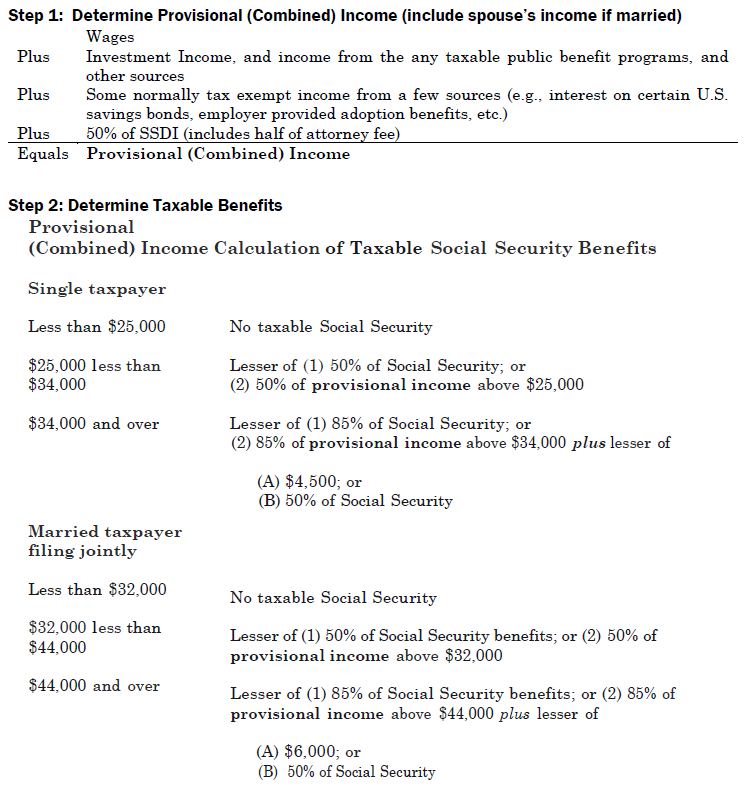

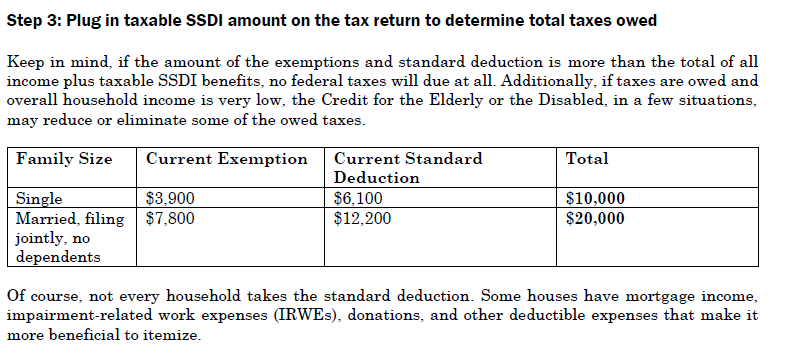

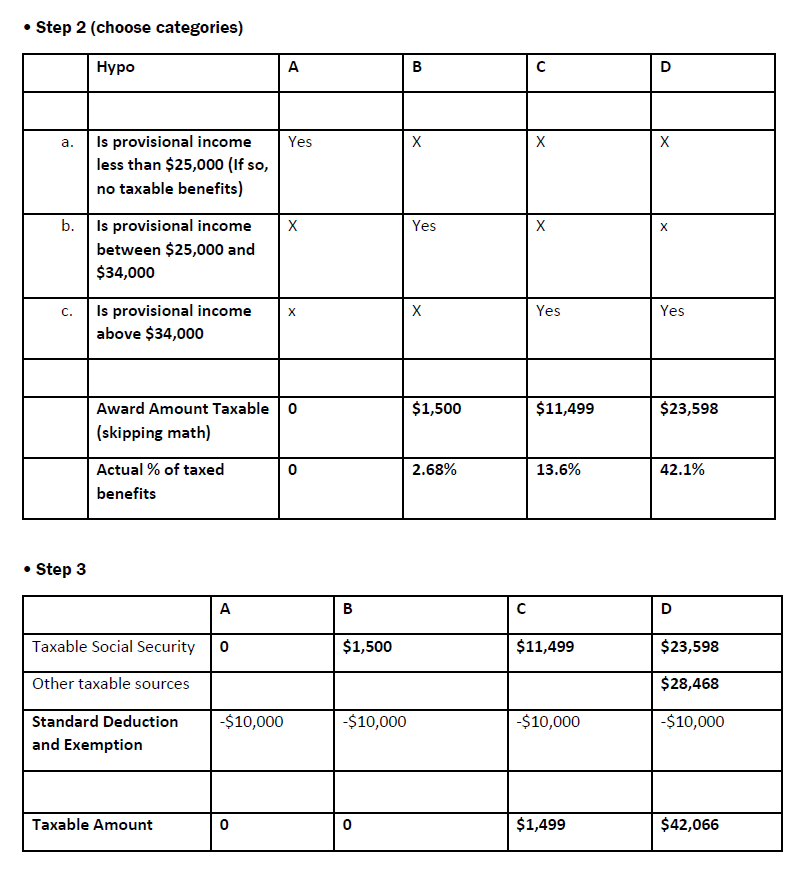

As you can see below, the pertinent calculations in determining taxable amount are often treacherous for non-accountants. See “Benefits Planner: Income Taxes and Your Social Security Benefits,” and “Social Security: Calculation and History of Taxing Benefits,” Christine Scott, 2/20/13. There are worksheets available in Publication 915. Also, counterintuitively, it should be noted that the amount of SSDI subject to taxation is not reduced by the amount of attorneys’ fees paid. Both beneficiaries and the representatives may pay taxes on a portion of the amount of the withheld fee.

The math

Table prepared by the Congressional Research Service (CRS), Social Security: Calculation and History of Taxing Benefits, Christine Scott, 2/20/13. However, references to Railroad Retirement benefits were deleted.

Provisional (combined) income (see above) is total income plus certain income exclusions plus one-half (50%) of Social Security Disability Insurance

SSDI Attorneys’ Fees

Note: Attorneys’ fees in SSDI claims almost always count as miscellaneous deductions. See: IRS Publication 529. Frequently attorneys’ fees are not high enough to be deducted.

Lump Sum Election

Your client can also elect to have all the retroactive benefits counted in one tax year or be divided pro rata on a month by month basis across multiple tax years without amending returns from past years. See IRS Code § 86(e), IRS Publication 915. Though this sounds appealing, if there is any other income in the household in past years, it is possible that your client will be paying more in taxes, even though less money is attributed to each year. If your client has any tax liability in the year s/he receives benefits, it is especially crucial consult a tax professional to figure out how to reduce taxes owed.

Withholding

Withholding taxes from monthly benefits is usually voluntary and can be requested through IRS Form W-4V. Amounts generally range from 7% to 25%. See Tax Witholdings. If too much is withheld, usually the claimant gets a refund. Unless, of course, it is intercepted by the IRS. [See below.]

Tax Refund Offset (Tax Refund Intercept) and IRS Liens

The IRS generally has the capacity to intercept the full tax refund of former recipients on behalf of SSA and some other federal agencies. With certain income limitations, the IRS also can also garnish or put liens on monthly SSDI payments for delinquent tax debt.

Generally, the collection is 15% per month from SSDI benefits. Certain monies cannot be levied, such as lump sum death payments, benefits paid to children, and payments from SSDI that are already being reduced to collect an overpayment.

Note that beneficiaries do have the right to appeal the accuracy of the debt, to offer a compromise lump sum, to request repayment at a slower rate, and to seek a hardship exemption. These rights are administered by the IRS. Debt collection activity should stop while the beneficiary seeks this relief. A tax professional should be consulted.

Workers’ Compensation (WC) Reduction

In most states, SSDI may be reduced for WC and other public disability benefits. Oddly, the amounts deducted are included as benefits received for purposes of income tax. In effect, state WC is rendered taxable in an amount equal to the Social Security reduction, but only to the extent that SSDI is taxable for the year [See IRS Code § 86(d)(3)].

Long Term Disability Insurance

Sometimes LTD benefits are paid and SSDI monies are later recouped by the LTD carrier. A beneficiary should be aware that simply because there are two 1099 statements received, the income cannot be taxed twice.

Auxiliary Payments

Payments on a wage earner’s record to auxiliaries is deemed income to the auxiliaries, who may need to file a separate tax return. Each family member receiving benefits should get a separate 1099. This also applies to children, see Instructions for Form 8615, Tax for Certain Children Who Have Unearned Income. However, if the SSDI payments amounts are a child’s only income, it would be extremely unlikely that the child would need to pay any tax.

The Moral

Have your clients get tax services from a professional who understands Social Security benefits.

Free resources include, the IRS Taxpayer Advocate Service is empowered to advocate for claimants and answer questions. The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) Programs offer free tax help for taxpayers who qualify.